Menu

Home Office

Lighting & Mirrors

Thank you for choosing to shop with Klarna.

This is a credit agreement between you and us. When we use ‘us’, ‘we’ or ‘our’ in this document, we mean Klarna Financial Services UK Limited. When we use ‘you’ in this document, we mean anyone who has bought something using Pay Later in 30 days (“Pay Later”) with Klarna.

Section 8 “Do you charge late fees?” applies to Pay Later credit agreements made on or after 16 March 2023. This section does not apply to Pay Later credit agreements made before this date.

You must be a UK resident, over 18 years old and have a valid payment card to use Pay Later. When we say ‘valid payment card’, we mean the card must be in your name, and must not have expired. You should also make sure the card you use has enough money available to cover your payment.

Pay Later is a credit product. It’s our decision whether or not we start a credit agreement with you.

With Pay Later, you can pay for something you buy up to 30 days from the order placement or shipment of your goods or when services you have purchased become available. We will send you a payment reminder with details on how to make payment to us directly, or if you have opted in for autopay notify you of any upcoming payments that will be withdrawn on due date. If you’d like to pay off your balance before the 30 days is up you can make a payment early through the Klarna App by paying by card immediately.

Klarna accepts most cards except prepaid cards. We’ll let you know at checkout if your card hasn’t been accepted.

Klarna offers consumers Buyer Protection which means for example that you as a consumer do not have to pay for the ordered goods until you have received them, and that Klarna will assist you with problems related to your purchase.

For more information and instructions please go to: https://www.klarna.com/uk/buyer-protection-description/.

If you cancel your purchase, we’ll cancel your outstanding payment that’s due. If you want to return part of your order, you’ll only have to pay for the goods you want to keep.

It is important that you complete your payment for your purchase no later than on the communicated due date. You can manually make a payment in the Klarna App using your card.

If you have opted in for autopay, Klarna will try to automatically withdraw the amount due on the due date. Klarna will notify you prior to the upcoming payment. If we can’t take the payment from your card, we’ll let you know, and try again one more time to take the money. We’ll let you know when we’re going to try again, so you’ll have plenty of time to put some money onto your card to make the payment.

If we can’t take the money from your card on the due date or on when we try again 7 days later, we will ask you to pay the outstanding amount directly in full. If you do not pay, we may use a debt collection agency to collect the money for us. A debt collection agency is an FCA regulated company used by Klarna to recover funds that are overdue.

Klarna will always get in touch with you before attempting to collect a payment from your card. We will also contact you if we plan to use a debt collection agency to recover the outstanding amount.

Not paying on time might also mean you can’t use Klarna credit products in the future. We will report information to credit reference agencies about the payments you make, and about any payments that you fail to make on time. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit from Klarna and other lenders in the future.

No. We might carry out a limited credit search on you at a credit reference agency. This is a ‘soft credit check’, and won’t affect your credit score, or your chances of using credit in the future. You’ll be able to see it on your credit file, but no one else will.

We will report information to credit reference agencies about the payments you make, and about any payments that you fail to make on time. Failure to pay on time might affect your ability to obtain credit in the future from Klarna and other lenders. More information about reporting to credit reference agencies can be found in Klarna’s Privacy Notice.

We will charge you a late fee if you do not pay us within 7 days after your payment is due. If you have opted into autopay, we’ll retry to charge your card once within this time. If we are not able to collect payment from you after the retry or you do not pay us manually then a late fee will be applied. You will not be charged a late fee if we collect payment or you pay us before then.

We’ll send you plenty of friendly reminders so you can make sure you’ve got enough money on your card before we collect payment from you or so you don’t miss your due date.

If your order is over £20, we will charge you a late fee of £5. If you only receive part of your order and the total value is £20 or less, the late fee will only be 25% of the purchase price of the order. For example, if your order’s total value is £16, you will be charged a £4 late fee, which is 25% of £16.

You will only be charged a maximum of two late fees per Pay Later order. We won’t charge you a late fee if you have less than £1 left to pay.

We may delay or decide not to charge you late fees. If we do not enforce our rights against you for late fees, this will not stop us enforcing those rights at a later date. If you think late fees have been charged in error, please contact Klarna Customer Services.

We use your personal data to identify you and to carry out customer analysis, credit assessments, credit reporting to credit reference agencies, marketing and business development. We might also share your data with some partners (such as credit reference bureaus), which might be based outside of the UK.

Please see our Privacy Notice here for more information about your rights, how you can get in touch with us, or to complain. By using Klarna’s services you confirm that you’ve read this notice.

You can make a complaint through our customer service webpage using our live chat feature, or by calling us on (+44) 0808 189 3333. We try to handle all complaints as quickly and smoothly as possible. You cannot make a complaint to the Financial Ombudsman Service about Pay Later.

If you’re not happy with our response, you can contact Klarna’s Complaints Adjudicator. Use the form provided alongside your final response.

You can find our full complaints information here.

This is a credit agreement between you and us. You can’t transfer your rights or obligations to anyone else unless you get our permission first.

We can transfer these terms, or any rights and obligations you have under them, at any time. We don’t need to ask for your consent to do this, unless transferring would harm your rights and responsibilities. This means we have the right to transfer the credit agreement to another provider without asking you.

Klarna Financial Services UK Limited (“Klarna”) is authorised and regulated by the Financial Conduct Authority (“FCA”) for carrying out regulated consumer credit activities (firm reference number 987889), and for the provision of payment services under the Payment Services Regulations 2017 (firm reference number 987816). Klarna provides both regulated and unregulated products. Klarna’s Pay in 3 instalments and Pay in 30 days agreements are not regulated by the FCA. Incorporated in England (company number 14290857), with its registered office at 10 York Road, London, England, SE1 7ND.

For further information about Klarna, go to: https://www.klarna.com/uk/

This Agreement is governed by the laws of England and is subject to the non-exclusive jurisdiction of the courts of England and Wales. If you are a resident of Northern Ireland you may also bring proceedings in Northern Ireland, and if you are a resident of Scotland, you may also bring proceedings in Scotland.

|

“Klarna's Pay in 3 / Pay in 30 days are unregulated credit agreements. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status. Late fees may apply. Ts&Cs apply.” |

Monday - Saturday: 9.00-5.30

Sunday: Closed

Bank Holidays: Closed

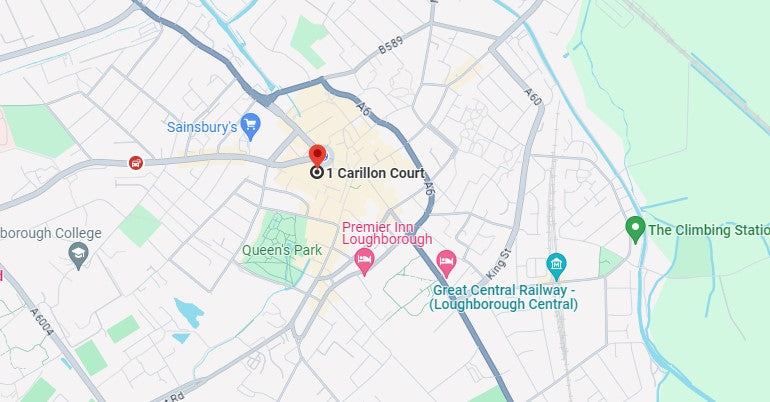

A trusted landmark in the town of Loughborough, Tylers Department Store is a unique family run and owned store, which has developed over the past 100 years. From it’s early beginnings as a traditional hardware store, to the existing luxury department store, the third generation of the Tylers family have successfully created a beautiful modern store that provides complete home solutions and luxurious giftware, jewellery, women's fashion and of course Tylers Café,

Sign up for our newsletter and be the first to know about coupons and special promotions.